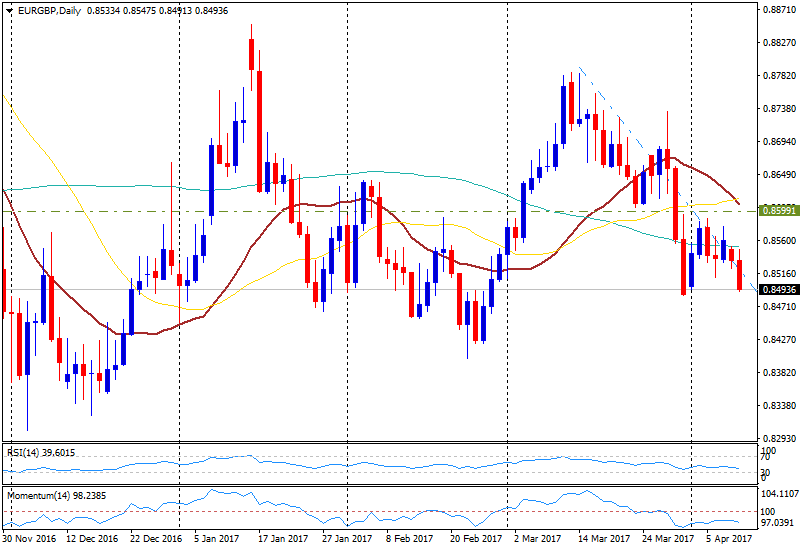

EUR/GBP breaks under 0.8500, eyes March lows

EUR/GBP has been falling constantly since the European session. On American hours broke below 0.8500 and fell to 0.8492, hitting the lowest level since March 31. Price remains near the lows, with the bearish momentum intact. While EUR/SUD continues to pullback toward 1.0600, the GBP/USD pair remain near daily highs, close to the 1.2500 area.

Currently, EUR/GBP trades at 0.8492/94, down 35 from yesterday’s closing price, the worst decline since the beginning of the month.

Data from UK and EZ

Economic data from Europe had a limited impact on the pair. UK inflation data showed the CPI slightly below expectations while wholesale inflation came in above. Tomorrow will be the turn of jobs data.

UK annualized CPI stays unchanged in March, core figures disappoint

The Germen ZEW survey showed better-than-expected numbers. With the current situation index up to 80.1 from 77.3, a new 6-year high. The euro gained momentum, momentary after the survey. Then, the EZ industrial production report was published and showed a decline of 0.3% in February (vs 0.1%).

German ZEW investor survey rose more than expected - BBH

Technical levels

To the downside support levels could be located at 0.8490 (Jan 30 & Feb 1 low), 0.8460/65 (Jan low) and 0.8455 (Feb low). On the upside, resistance could now be located at 0.8515 (Asian session low), 0.8545/50 (daily high) and 0.8565 (Apr 6 high).