USD/JPY Technical Analysis: Bulls brake above 111.00 level

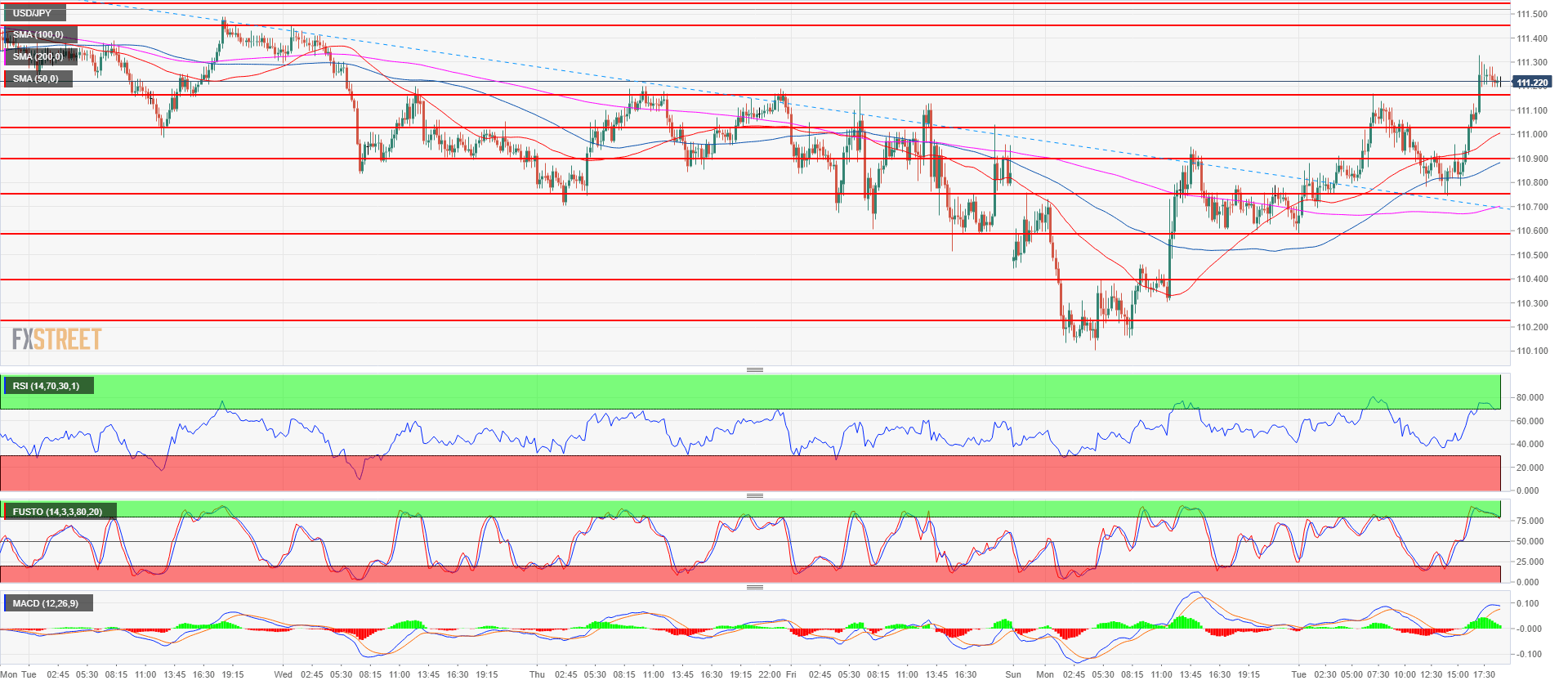

- Support at 110.75 held and bulls lifted the market about 55 pips from there. Bulls objective is to target 111.45 and 111.54-111.64 area in the coming sessions.

- Near-term supports are located near the 111.02-111.16 area, 110.90 and 110.75, July 23 low.

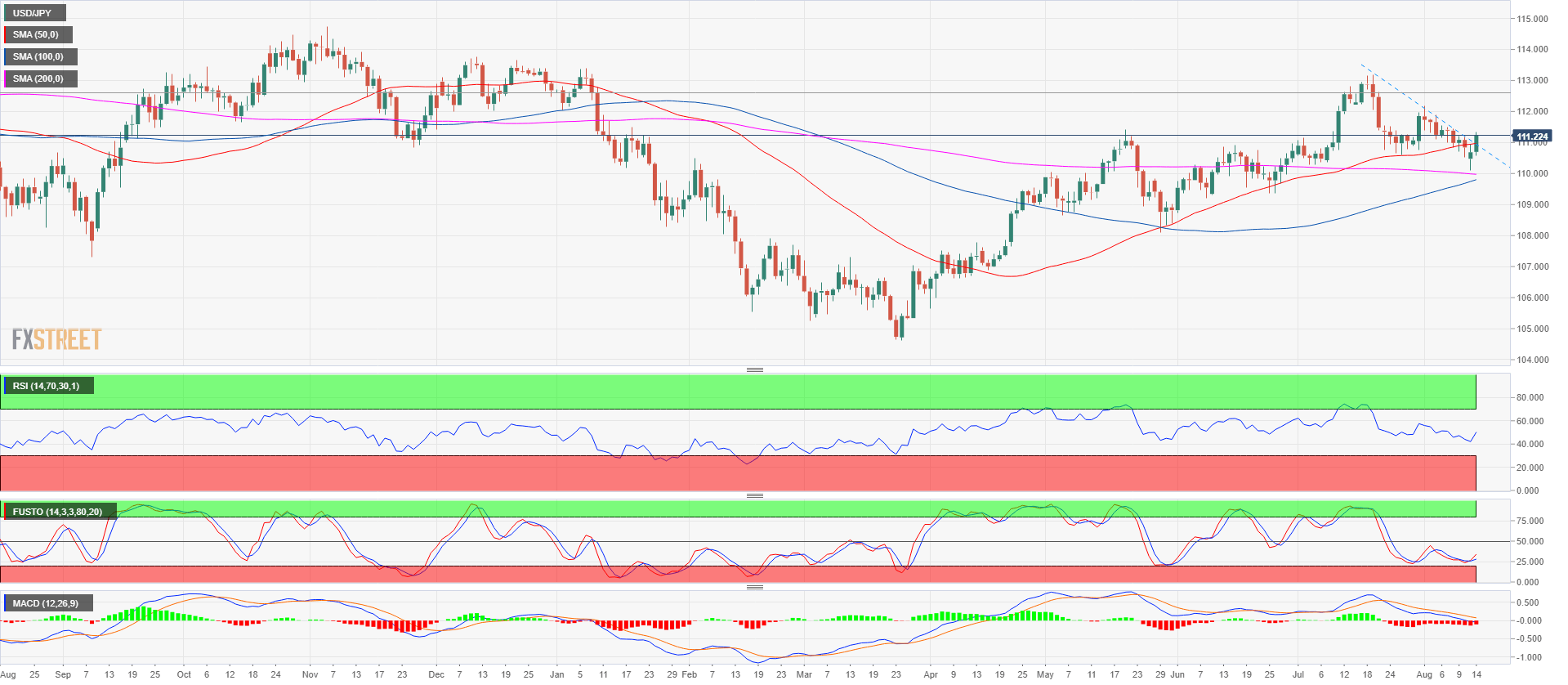

- USD/JPY is trading at its highest in the last three sessions after rebounding from the 200-daily simple moving average, suggesting a bullish bias.

USD/JPY 15-minute chart

USD/JPY daily chart

Spot rate: 111.21

Relative change: 0.47%

High: 111.33

Low: 110.58

Trend: Bullish

Resistance 1: 111.45 August 8 high

Resistance 2: 111.54-111.64 area, August 6, high and supply/demand level

Resistance 3: 111.82-112.00 area, supply level and figure

Resistance 4: 112.19-112.40 area, July 11 high and intraday swing low

Resistance 5: 112.64 July 12 high

Resistance 6: 113.18, 2018 high

Resistance 7: 113.26-113.38, 200-weekly simple moving average and January 8 high

Resistance 8: 114.45 October 27, 2017 high

Support 1: 111.02-111.16 area, figure and current August 6 low

Support 2: 110.90 June 15 swing high

Support 3: 110.75, July 23 low

Support 4: 110.58 July 26 swing low

Support 5: 110.40 demand level

Support 6: 110.27 July 4 low