Back

1 Feb 2019

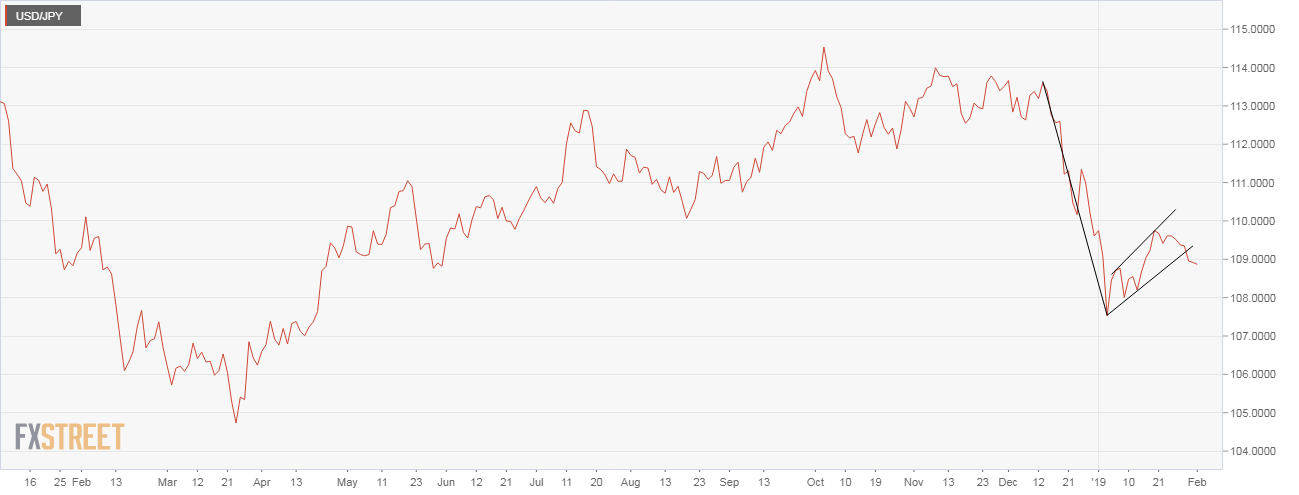

USD/JPY Technical Analysis: Bear flag breakdown confirmed on the line chart

- The USD/JPY pair closed yesterday at 108.85, confirming a bear flag breakdown on the daily line chart.

- That pattern usually ends up accelerating the preceding bearish move. Put simply, the pattern has opened up downside toward 103.00 - target as per the measured move method, that is, pole length subtracted from breakdown price.

- The bearish setup would be invalidated above the psychological hurdle of 110.00.

Daily chart

Trend: bearish

USD/JPY

Overview:

Today Last Price: 108.87

Today Daily change: -5 pips

Today Daily change %: -0.05%

Today Daily Open: 108.92

Trends:

Daily SMA20: 109.01

Daily SMA50: 110.85

Daily SMA100: 111.89

Daily SMA200: 111.26

Levels:

Previous Daily High: 109.08

Previous Daily Low: 108.5

Previous Weekly High: 110

Previous Weekly Low: 109.14

Previous Monthly High: 110

Previous Monthly Low: 104.75

Daily Fibonacci 38.2%: 108.72

Daily Fibonacci 61.8%: 108.86

Daily Pivot Point S1: 108.58

Daily Pivot Point S2: 108.24

Daily Pivot Point S3: 107.99

Daily Pivot Point R1: 109.17

Daily Pivot Point R2: 109.42

Daily Pivot Point R3: 109.76