EUR/USD Technical Analysis: FOMC knee-jerk reaction down - Euro bulls waiting around the corner

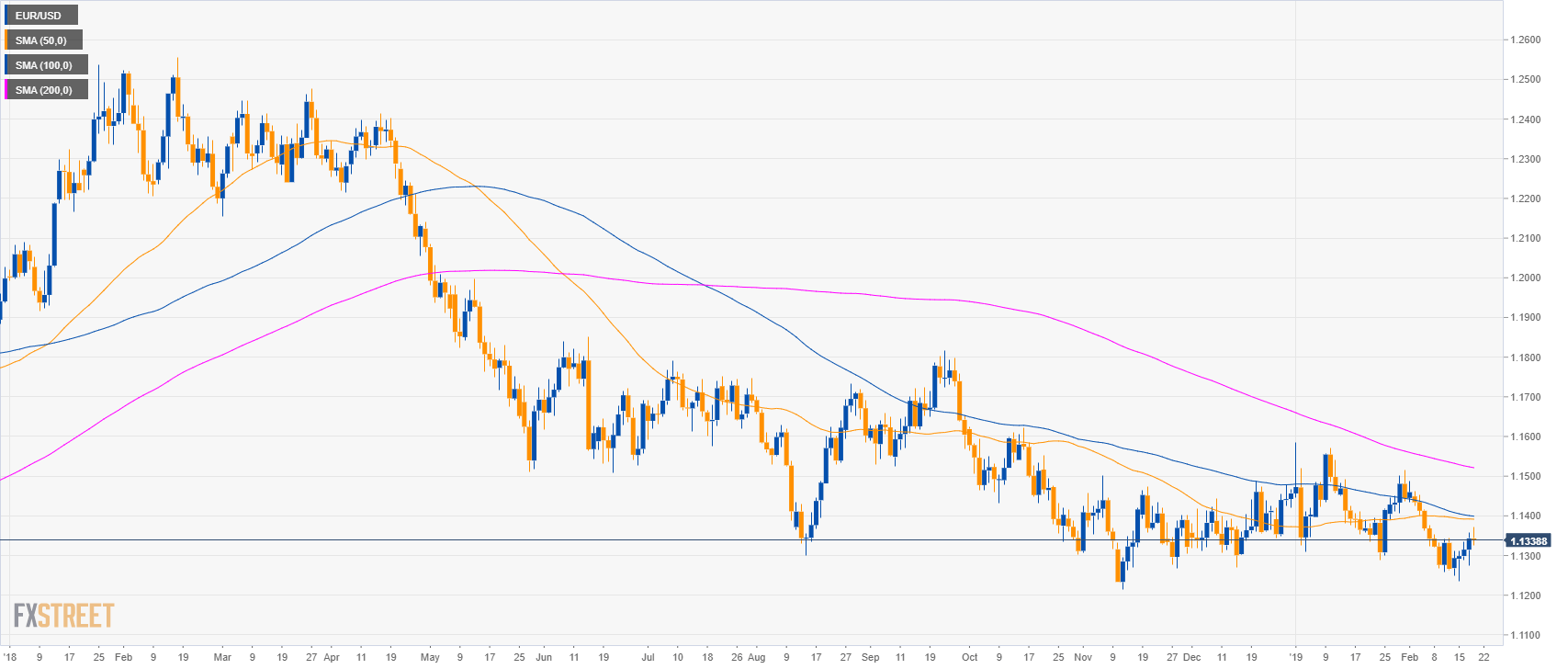

EUR/USD daily chart

- EUR/USD is evolving in a bear trend below the 200-day simple moving average (SMA).

- EUR/USD dropped about 30 pips after the release of the FOMC Minutes which were less dovish than expected.

- However, this is most likely to be seen as a small pullback down as Euro bulls should be back rather soon.

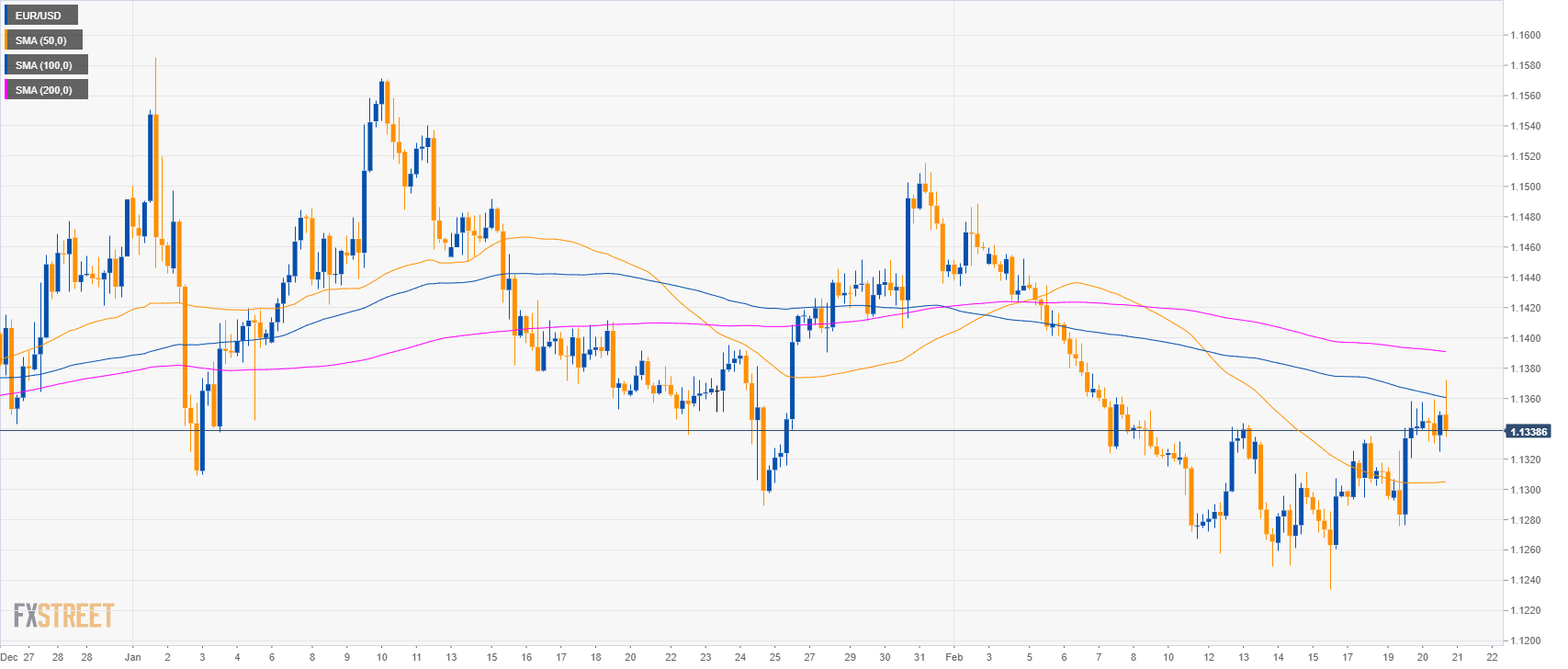

EUR/USD 4-hour chart

- EUR/USD is currently rejecting the 100 SMA.

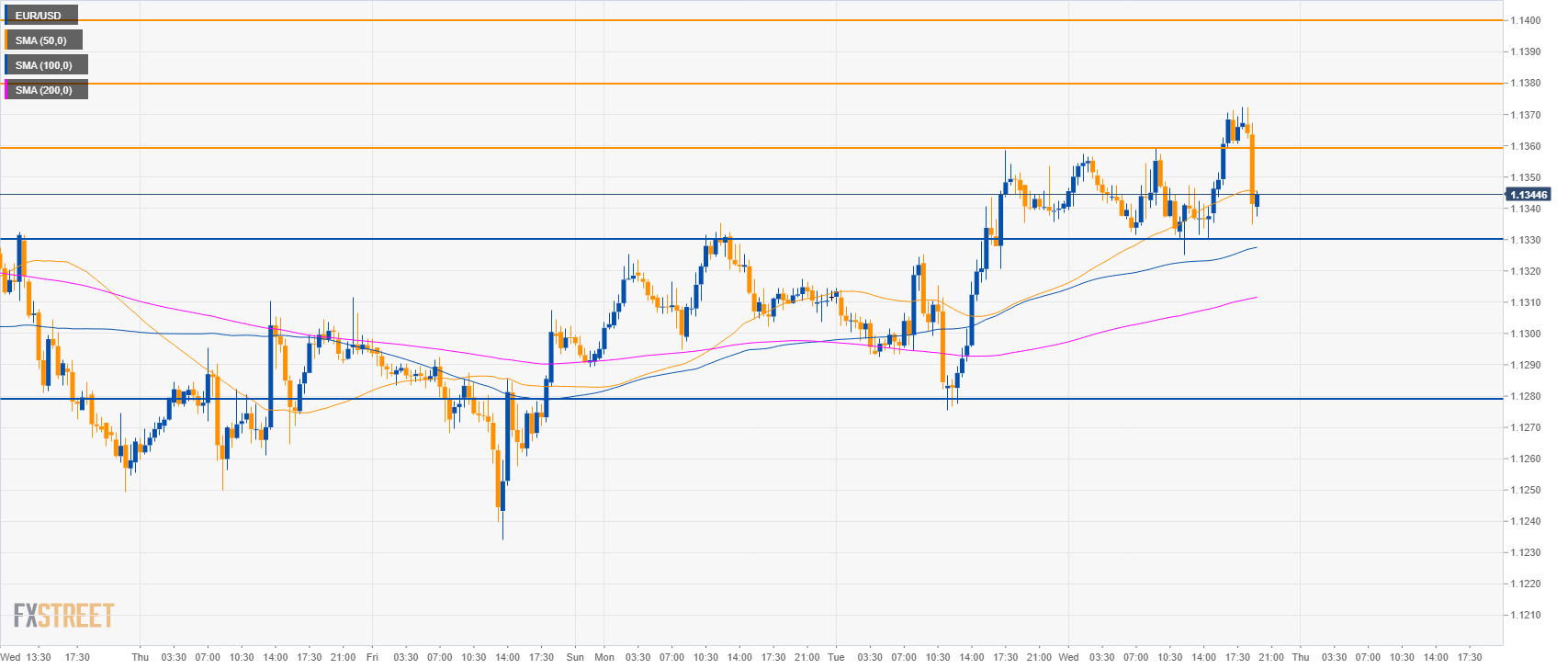

EUR/USD 30-minute chart

- EUR/USD is trading above the 200 SMA but bears are trying to brake below the 50 SMA suggesting a pullback.

- Bulls are still in contriol and a break above 1.1360 should lead to 1.1380 and 1.1400 figure.

- To the downside, support is at 1.1330 and 1.1280 key level.

Additional key levels

EUR/USD

Overview:

Today Last Price: 1.1341

Today Daily change: -2 pips

Today Daily change %: -0.02%

Today Daily Open: 1.1343

Trends:

Daily SMA20: 1.1368

Daily SMA50: 1.1392

Daily SMA100: 1.14

Daily SMA200: 1.1524

Levels:

Previous Daily High: 1.1358

Previous Daily Low: 1.1276

Previous Weekly High: 1.1344

Previous Weekly Low: 1.1234

Previous Monthly High: 1.1586

Previous Monthly Low: 1.1289

Daily Fibonacci 38.2%: 1.1327

Daily Fibonacci 61.8%: 1.1307

Daily Pivot Point S1: 1.1293

Daily Pivot Point S2: 1.1243

Daily Pivot Point S3: 1.121

Daily Pivot Point R1: 1.1376

Daily Pivot Point R2: 1.1409

Daily Pivot Point R3: 1.1459