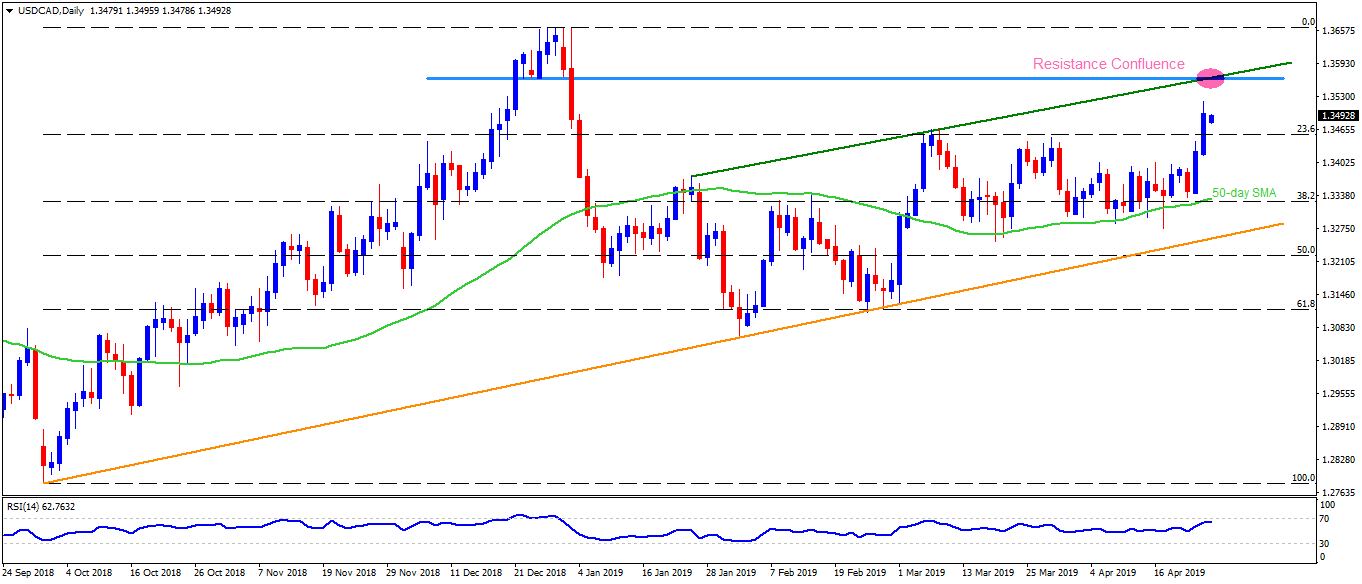

USD/CAD Technical Analysis: overbought RSI, 1.3565/70 confluence can question Bulls

The Canadian Dollar (CAD) is trading around 1.3500 versus the US Dollar (USD) during early Asian sessions on Thursday. The Loonie pair surged to a 16-week high on Wednesday after the BoC meeting and is still in the positive territory. However, overbought RSI conditions and near to important resistance-confluence can challenge buyers.

While 1.3525 can act as immediate resistance for the quote, an ascending trend-line from late-January and multiple lows from December 24 to January 02 may question the strength of buyers around 1.3565/70.

Adding to the buyers’ challenge can be overbought conditions of 14-day relative strength index (RSI).

Should the Bulls manage to conquer 1.3570, 1.3610/15 and 1.3665 may offer halts to its rally targeting 1.3700 round-figure.

On the downside, March month highs near 1.3470 may act as nearby support, a break of which may recall 1.3440 and 1.3400.

Though, 50-day simple moving average (SMA) near 1.3330 and an ascending support-line from October 2018 at 1.3250 could restrict further declines.

USD/CAD daily chart

Trend: Pullback expected