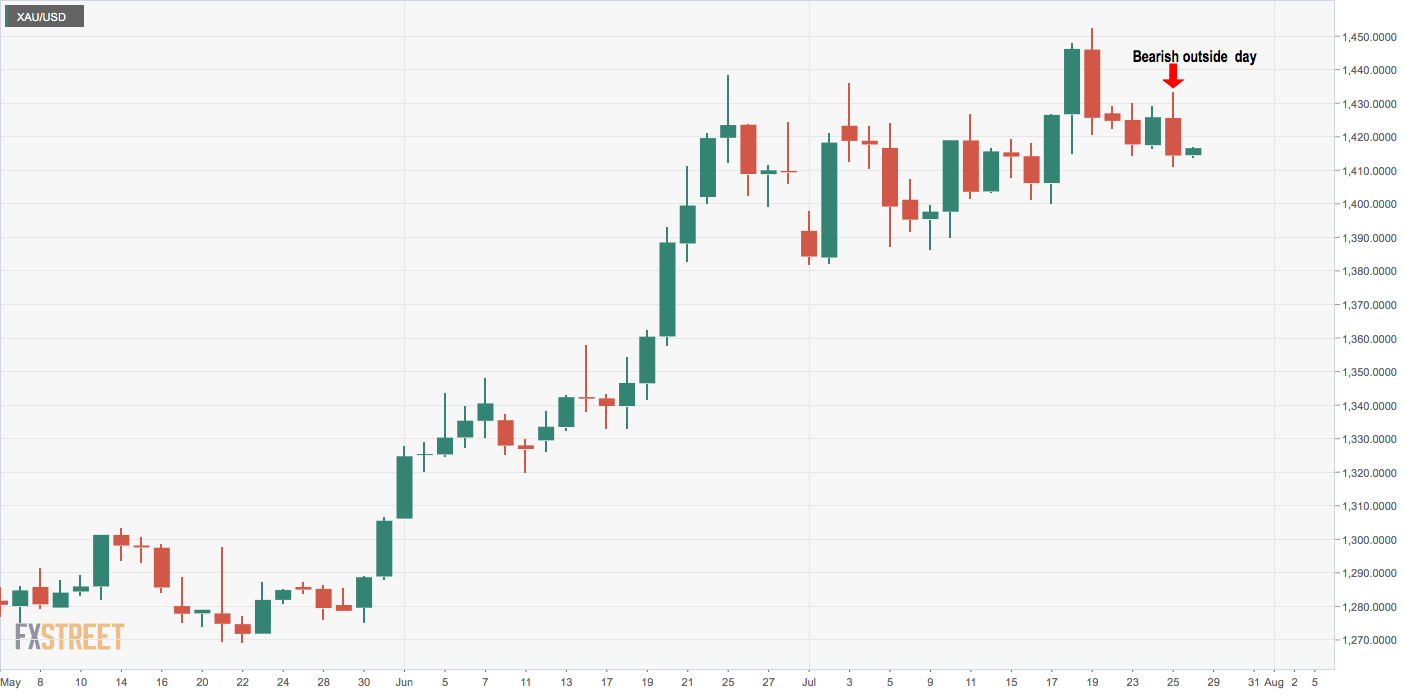

Gold technical analysis: Eyes 50-day MA support after bearish outside day

- Gold created a bearish outside day on Thursday.

- The candlestick pattern indicates scope for deeper correction.

- The immediate support is located at $1,406 (50-day MA).

Gold risks falling to the 50-day moving average (MA) support, currently at $1,406, having created a bearish outside day candle on Thursday.

A bearish outside day occurs when the day begins on an optimistic note but ends with pessimism, engulfing the price action see in the previous day.

It is considered a bearish reversal and a bearish continuation pattern depending on its position.

In Gold’s case, the candlestick has appeared following a pullback from the six-year high of $1,452 and indicates continuation of the correction.

Further, the 14-day relative strength index (RSI) is reporting a bearish divergence and the moving average convergence divergence is printing negative numbers, a sign the bearish momentum is gaining strength.

The yellow metal, therefore, risks falling to the 50-day MA support st $1,406. At press time, Gold is trading at $1,416 per Oz.

Daily chart

Trend: Bullish

Pivot points