Back

5 Dec 2019

US Dollar Index price analysis: DXY trading near 97.40 level, under pressure below the 200 DMA

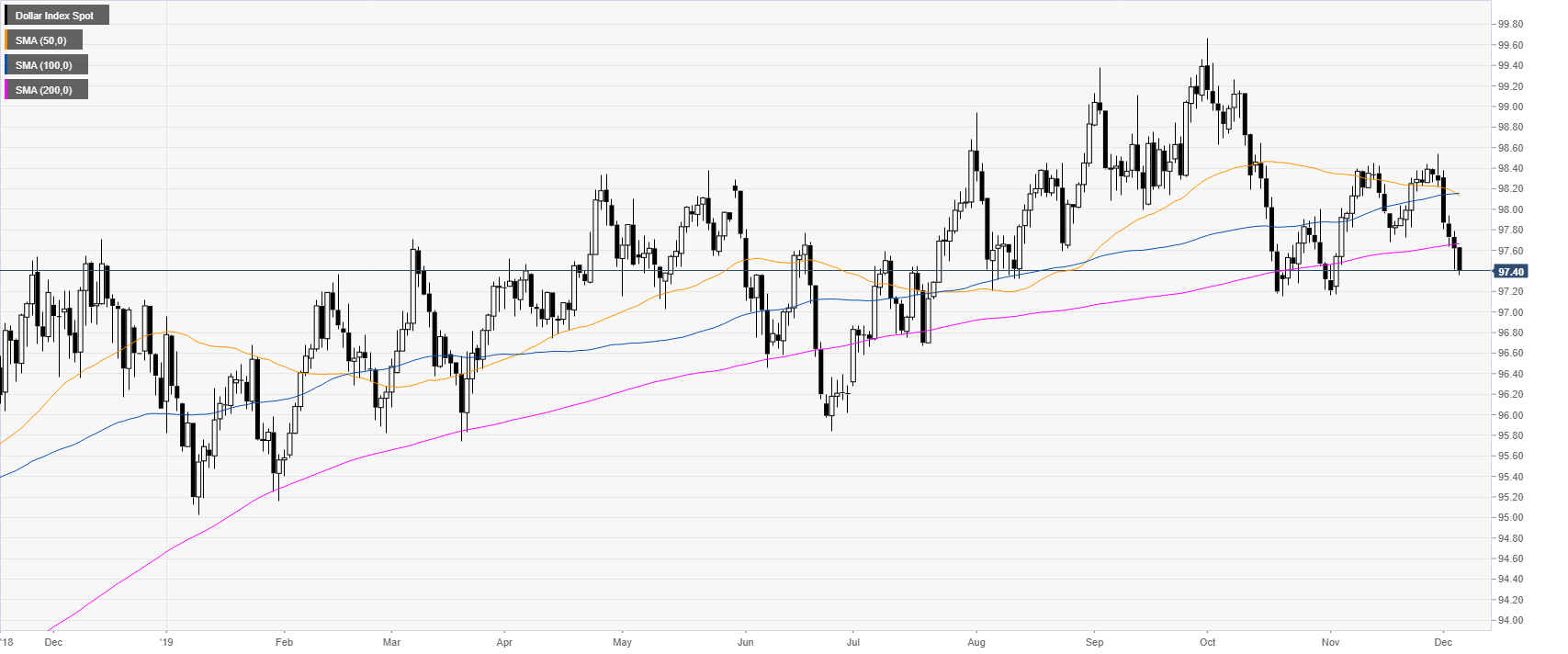

- DXY is continuing the slow and gradual decline started at the start of the week.

- A drop to the 97.20 level seems virtually inevitable.

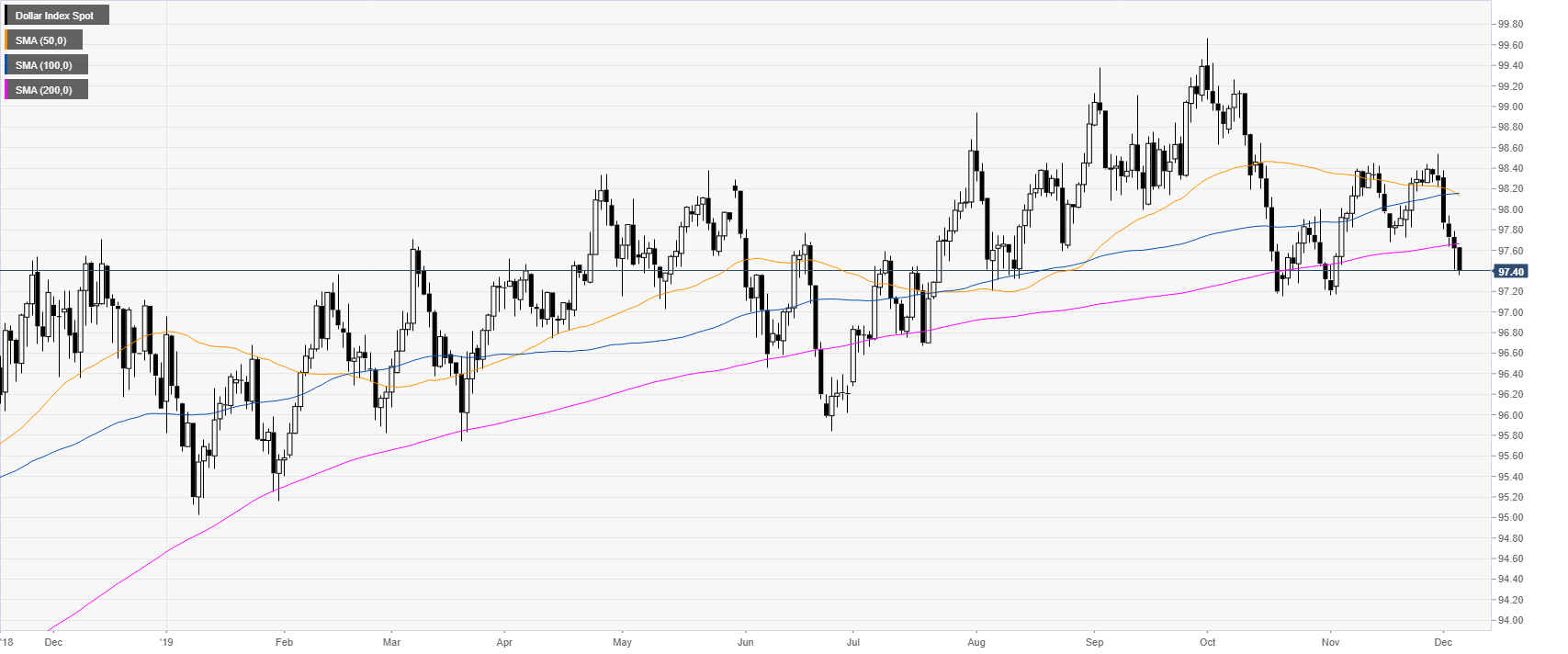

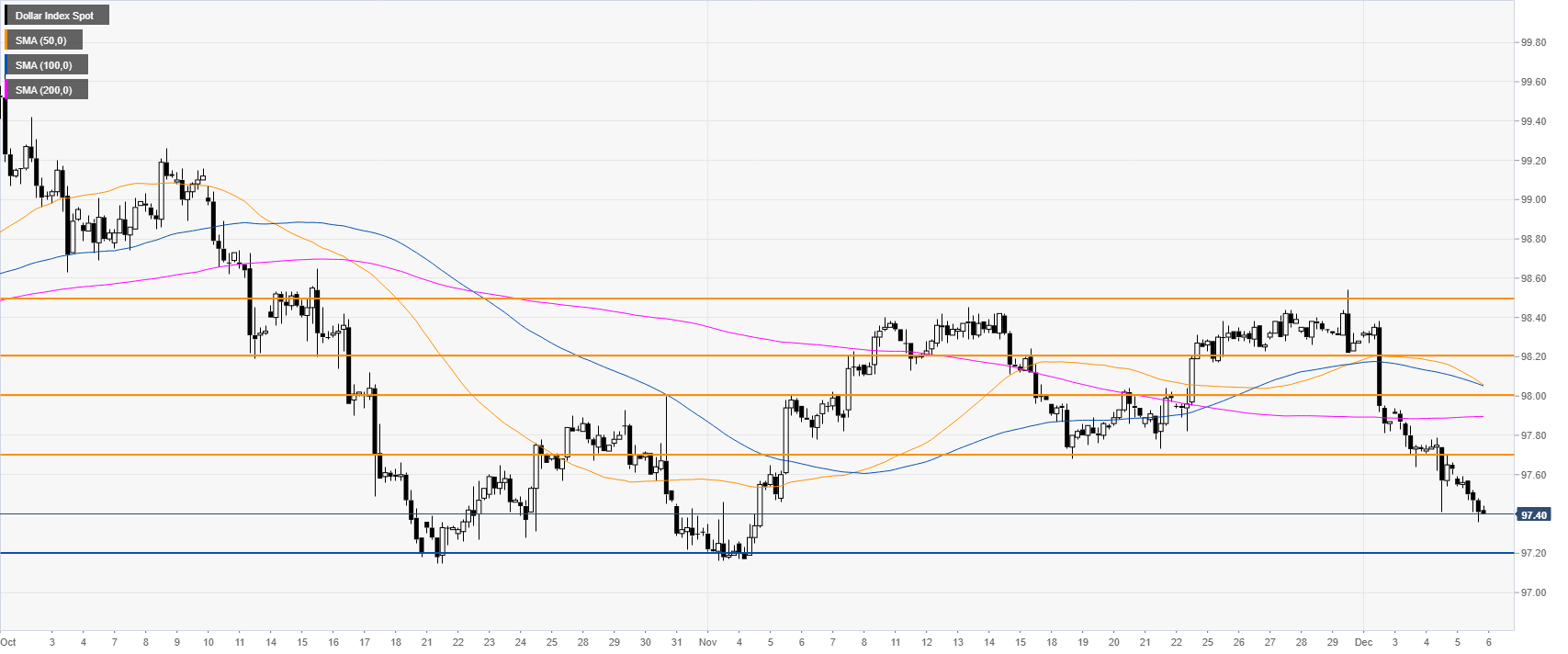

DXY daily chart

DXY (US Dollar Index) is trading in a weak uptrend. However, the market is below the 200-day simple moving average (DMA), suggesting that the index is weakening considerably.

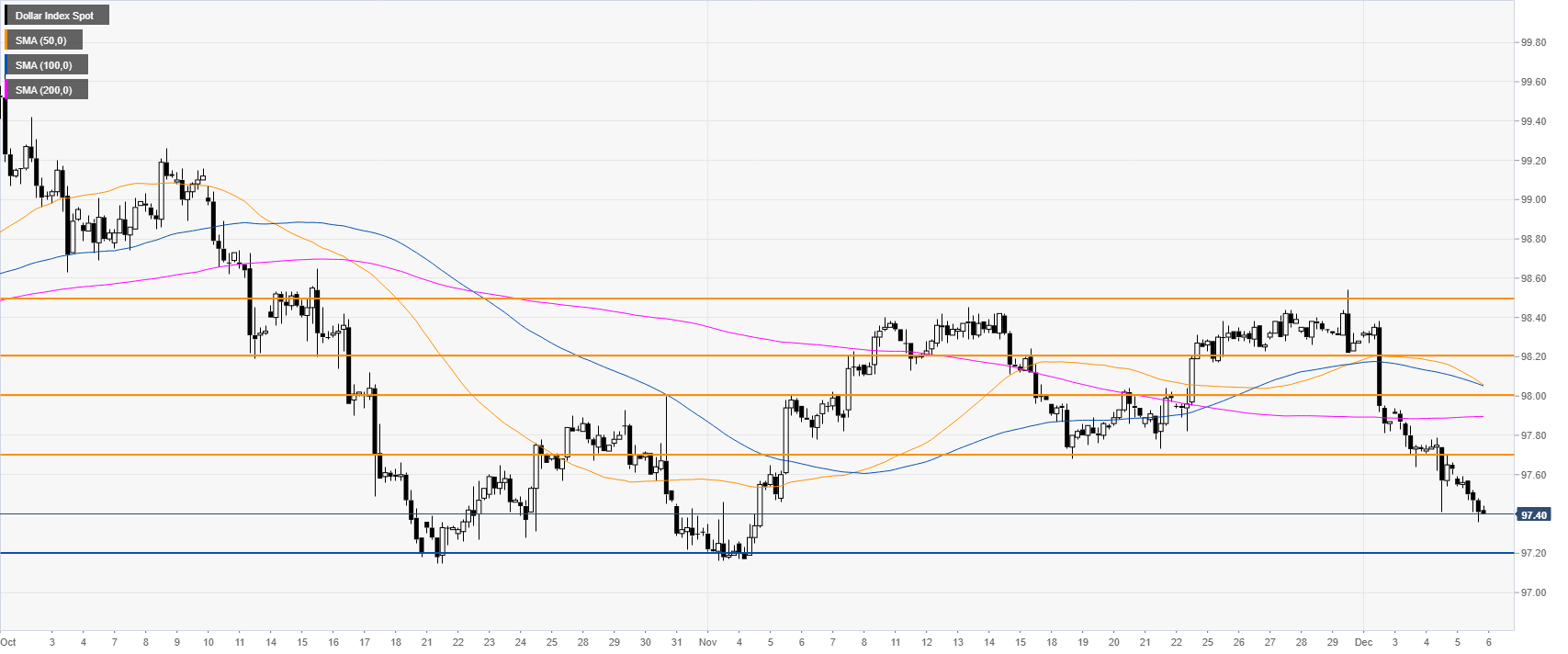

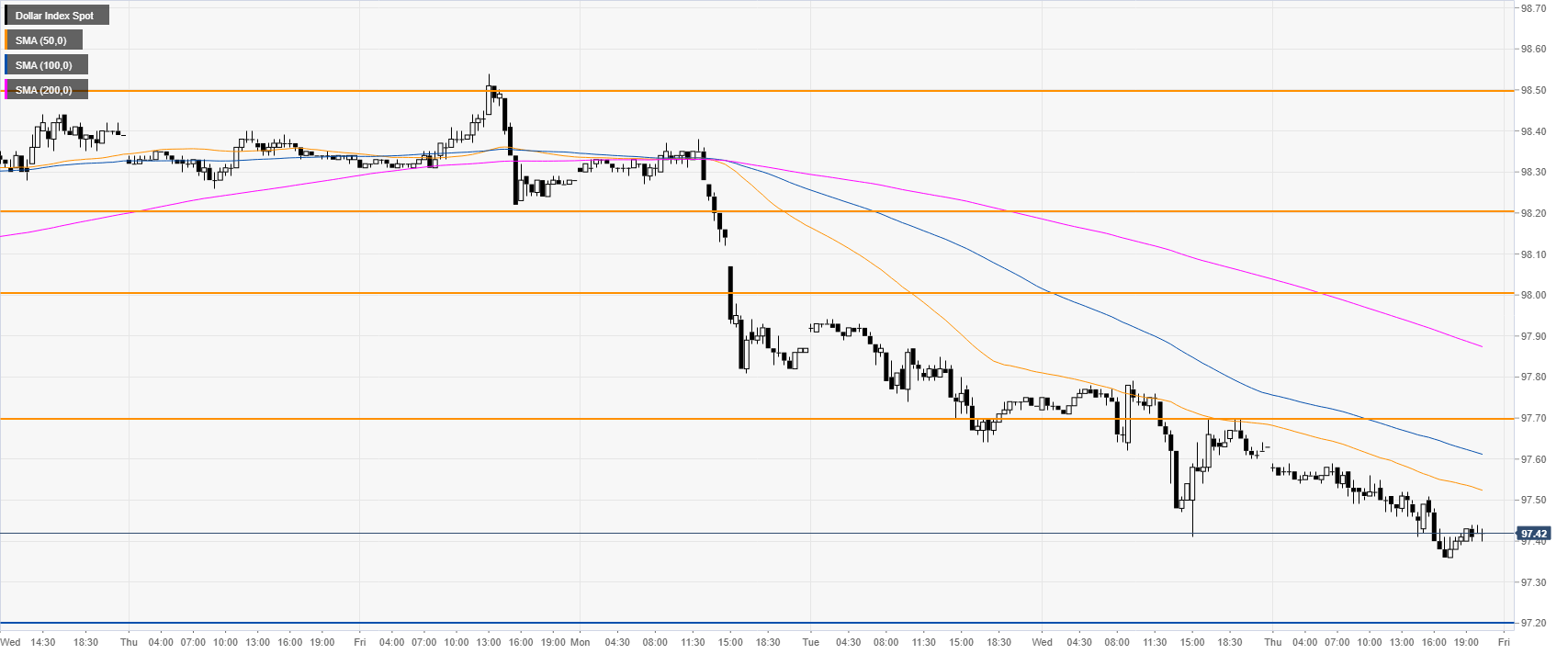

DXY four-hour chart

DXY is grinding lower while trading below its main SMAs. A drop to the 97.20 support level seems almost inevitable as bulls seem to have given up for the time being.

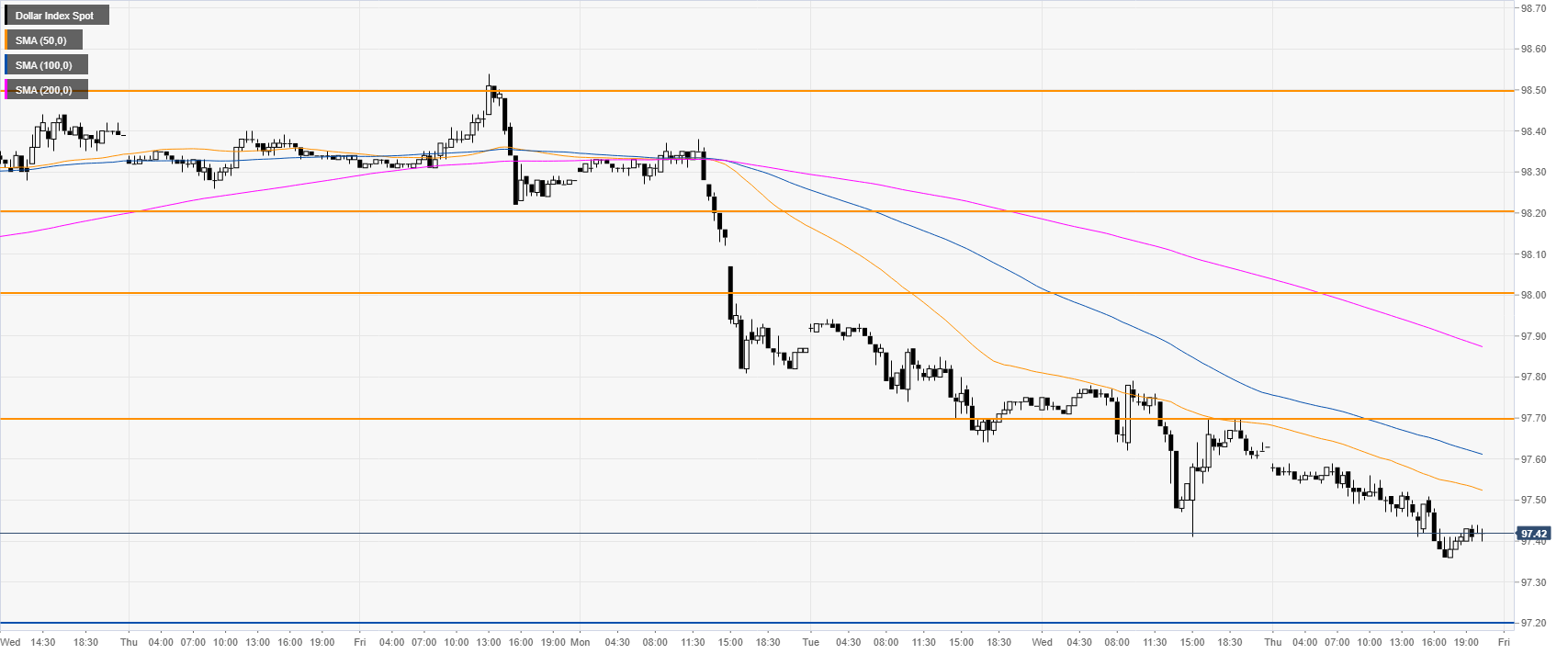

DXY 30-minute chart

The greenback is under selling pressure below the main SMAs. Resistance can be expected near the 97.70 and 98.00 levels in the short term.

Additional key levels