Back

8 Jan 2020

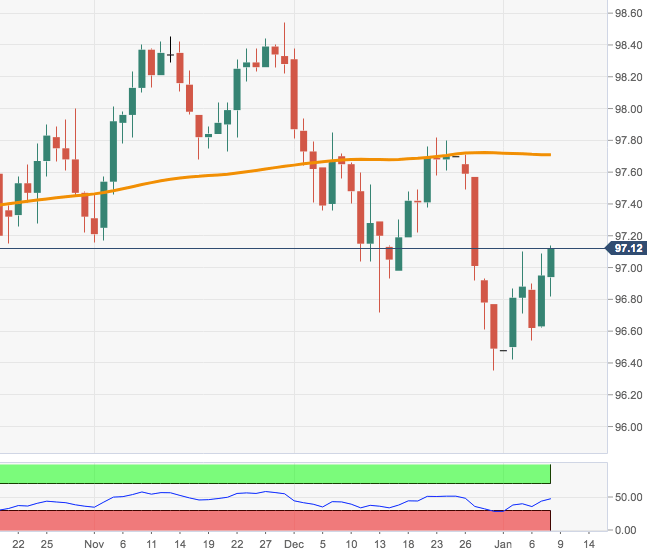

US Dollar Index Technical Analysis: Next stop at 97.70, the 200-day SMA

- DXY is looking to clear 97.00 on a sustainable fashion.

- The immediate target is now the 200-day SMA around 97.70.

DXY is extending its rebound beyond the key barrier at 97.00 the figure as geopolitical jitters ebb further and US yields resume the upside.

In case the recovery gathers serious traction, the index is expected to visit the critical 200-day SMA, today at 97.69.

Further up emerges the 98.00 neighbourhood, reinforced by the proximity of a Fibo retracement of the 2017-2018 drop at 97.87 and the 100-day SMA, today at 97.97.

DXY daily chart