Back

16 Jan 2020

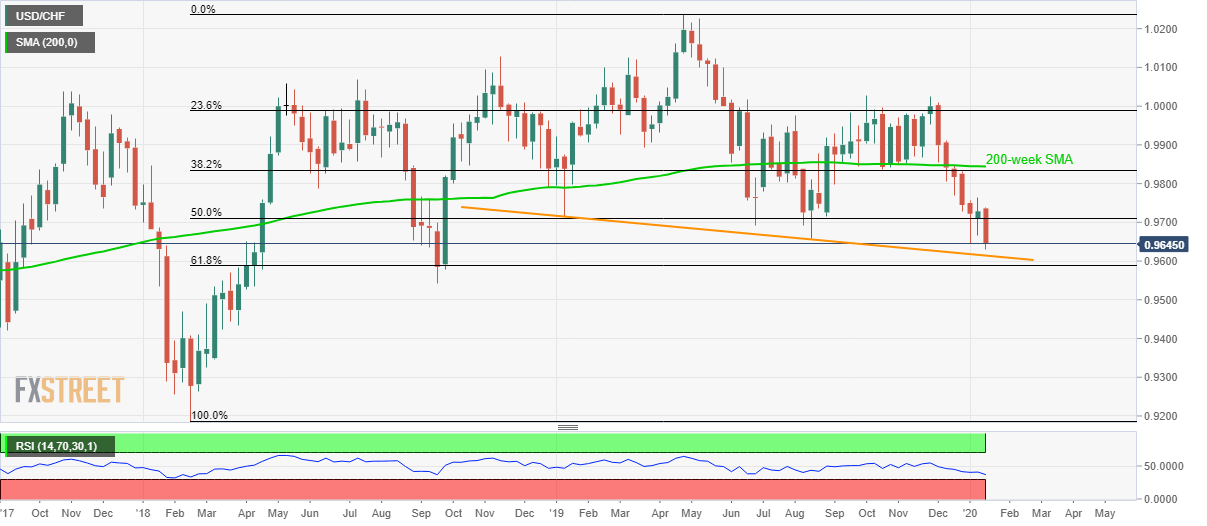

USD/CHF Price Analysis: Yearly trendline, 61.8% Fibonacci on the bears’ radar

- USD/CHF trades near the multi-month low marked Wednesday.

- 38.2% Fibonacci retracement, 200-week SMA keep the pair’s upside limited.

- September 2018 low may return to the chart during heavy declines.

USD/CHF takes rounds to 0.9645 while heading into the European session on Thursday. The pair witnesses pullback from the lowest since September 2018, tested the previous day.

Bears are in control while targeting a downward sloping trend line since January 2019, at 0.9615, as well as 61.8% Fibonacci retracement of 2018-19 upside, near 0.9585.

Given the sellers’ failure to respect the key Fibonacci support, September 2018 bottom surrounding 0.9540 grabs the spotlight.

Alternatively, 0.9765 can act as an immediate upside barrier ahead of the 200-week SMA and 38.2% Fibonacci retracement around 0.9835/45 region.

USD/CHF weekly chart

Trend: Bearish