GBP/USD Price Analysis: Spikes to weekly tops, tests 200-hour SMA

- GBP/USD gains some traction for the third consecutive session on Thursday.

- The set-up favours bulls, albeit warrants caution amid fears of a no-deal Brexit.

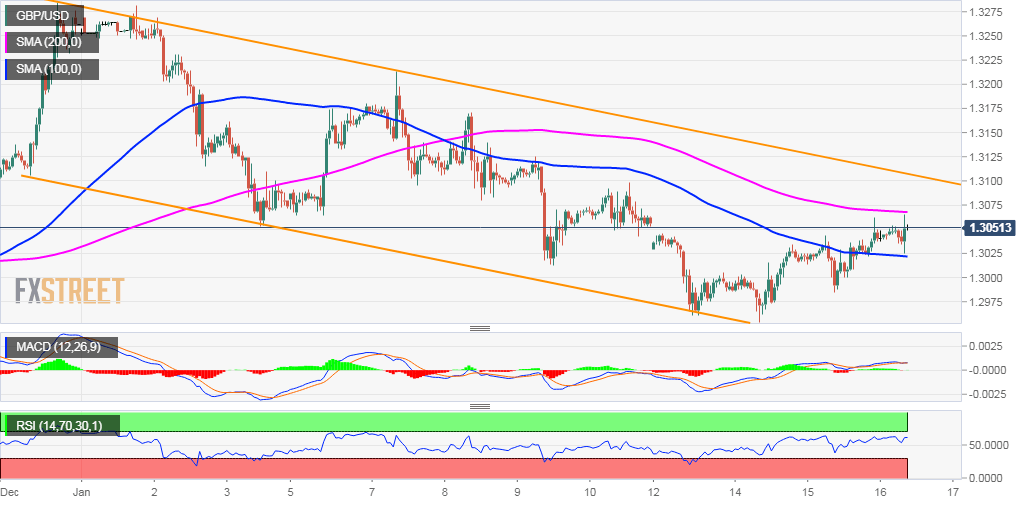

The GBP/USD pair added to its recent recovery move and gained some follow-through traction for the third consecutive session on Thursday. The momentum lifted the pair to fresh weekly tops in the last hour, with bulls now eyeing a move beyond 200-hour SMA.

This is followed by a resistance marked by the top end of over two-week-old descending trend-channel, around the 1.3100 handle. A sustained move beyond the said barrier might be seen as a key trigger for bullish traders and pave the way for a further appreciating move.

Meanwhile, technical indicators on hourly charts have been gaining positive traction and also recovered from the negative territory on the daily chart. The set-up seems tilted in favour of bullish traders, albeit concerns about a no-deal Brexit might continue to cap strong gains.

Hence, it will be prudent to wait for some strong follow-through buying beyond the trend-channel resistance before placing any fresh bullish bets. The pair might then accelerate the move towards the 1.3165-70 supply zone en-route the 1.3200 round-figure mark.

On the flip side, any meaningful pullback below 100-hour SMA, around the 1.3025-20 region, now seems to find decent support near the key 1.30 psychological mark. Below the said support, the pair might slide towards challenging the trend-channel support, currently near the 1.2900 handle.

GBP/USD 1-hourly chart