Back

31 Mar 2020

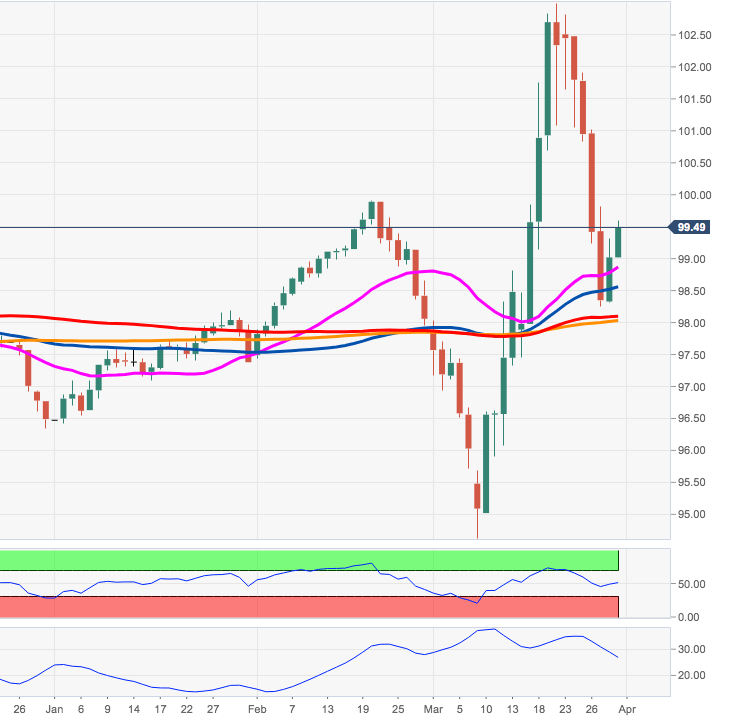

US Dollar Index Price Analysis: Target is now at the 100.00 mark and above

- DXY manages to surpass the 99.00 mark at the beginning of the week.

- The outlook remains positive above the 200-day SMA at 98.00.

DXY met solid contention in the vicinity of the key 200-day SMA just above 98.00 the figure so far this week.

If the bullish attempt picks up extra pace, then a potential visit to the psychological 100.00 barrier should return to the investors’ radar ahead of the Fibo retracement at 100.49.

So far, the positive outlook on the dollar remains unchanged as long as the 200-day SMA around 98.00 holds the downside.

DXY daily chart