EUR/GBP holds firm on to gains, above 0.8800

- EUR/GBP surges on Tuesday, the best day in almost a month.

- Pound drops sharply in risk aversion, the worst G10 currency of the day.

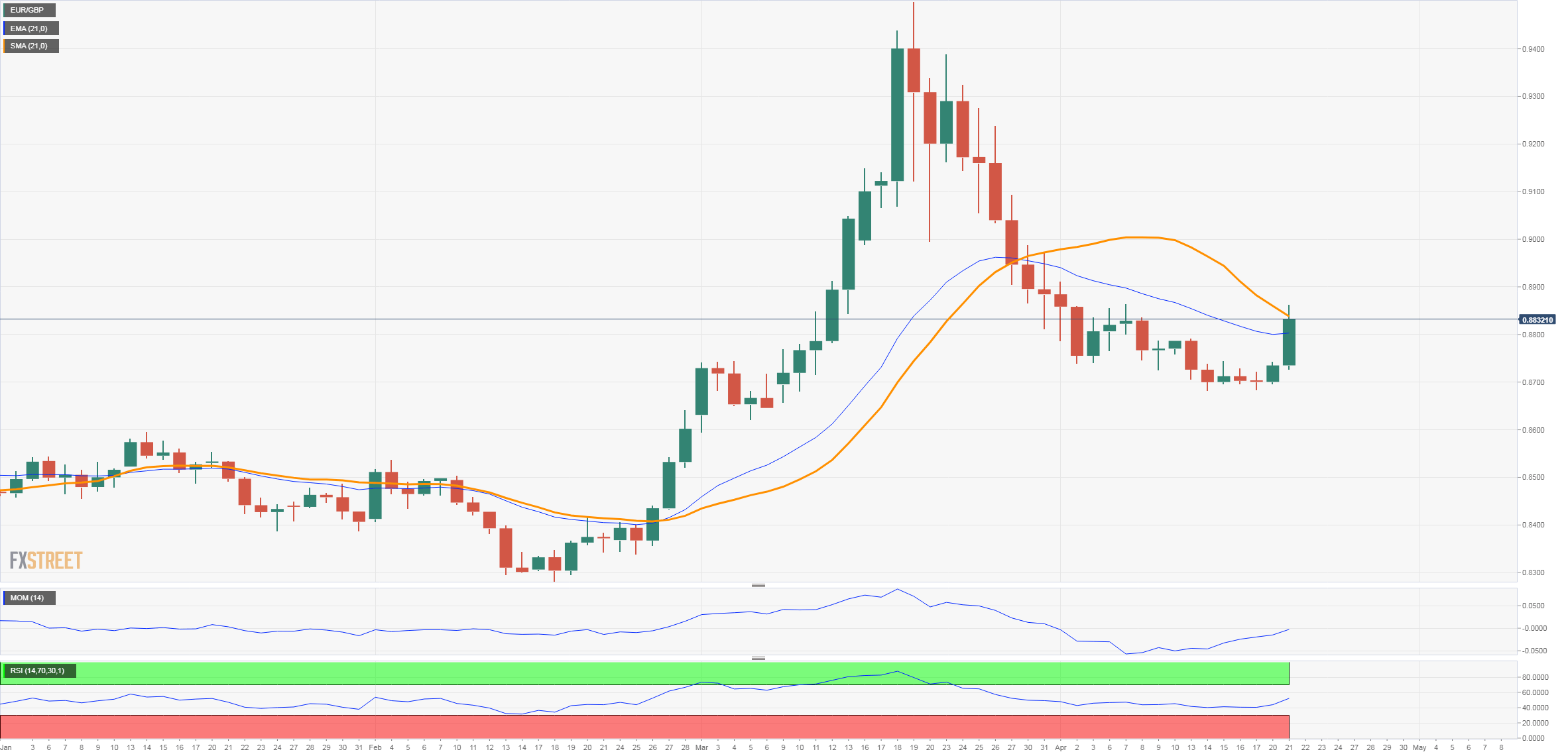

The EUR/GBP broke a five-day trading range to the upside and jumped to 0.8863, reaching the highest level since April 7. It then pulled back, holding firm on to daily gains and above 0.8800. It is hovering around 0.8830/35, up almost a hundred pips for the day, the best performance so far in April.

The decline in equity markets weakened the pound that fell across the board. It fell against all its main rivals and even versus some emerging market currencies. Many days of stabilisation around the pound ended abruptly on Tuesday. On Wednesday, inflation data in the United Kingdom is due. The employment numbers on Tuesday came in mixed, having no impact on the market.

The key driver behind the slide of the pound was the deterioration in market sentiment. The Dow Jones was falling by more than 2% and the Nasdaq almost 3%. In Europe, the FTSE 100 lost 2.96% and the DAX 3.99%. The return of risk aversion should keep the pound under pressure.

Technical outlook

The price climbed back above the 20-day moving average that stands around 0.8820, and the daily chart shows momentum and RSI moving north, all pointing to further strength. A retreat below 0.8745/50 would remove the current bullish bias. The rebound in EUR/GBP started after it was unable to break under the support zone around 0.8680.