Back

28 Apr 2020

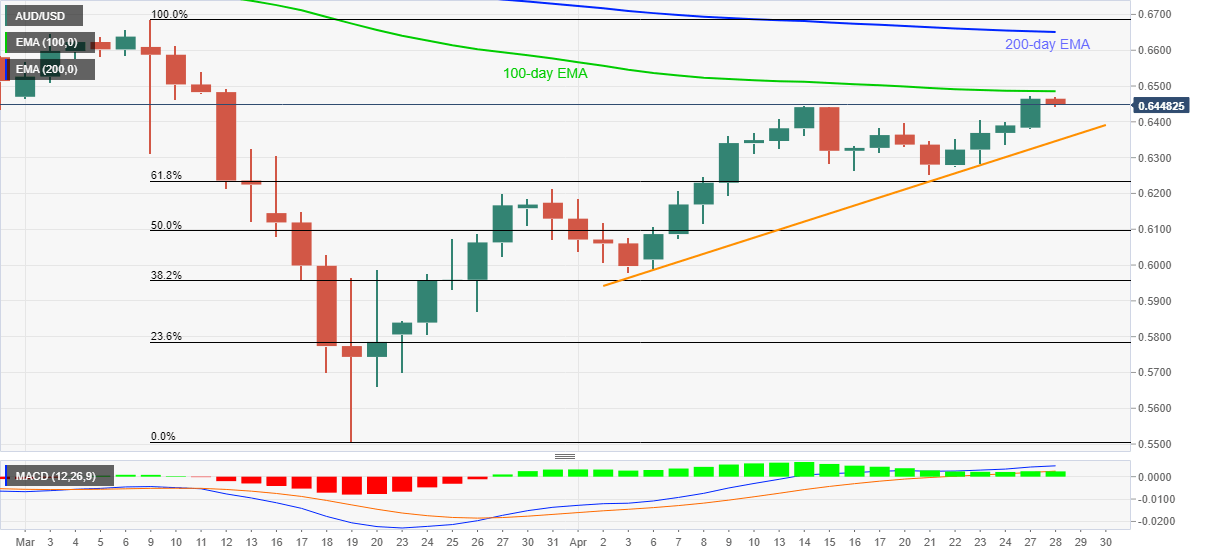

AUD/USD Price Analysis: 100-EMA probes multi-day top above 0.6400

- AUD/USD steps back from the highest since March 12.

- Bullish MACD keeps buyers hopeful but the key EMA questions further upside.

- Sellers will look for entries below a three-week-old ascending trend line.

AUD/USD steps back from 33-day high while declining to 0.6450, down 0.20% on a day, amid the Asian session on Tuesday. While a short-term rising trend line portrays the pair’s upward trajectory, coupled with the bullish MACD, 100-day EMA guards the pair’s immediate upside.

As a result, fresh buying could be witnessed only if the pair manages to provide a successful break above 0.6485 EMA figures.

In doing so, 200-day EMA near 0.6650 can offer an intermediate halt to the run-up towards March month high of 0.6686.

Meanwhile, the pair’s declines below a three-week-old support line, currently near 0.6345, can drag it to 61.8% Fibonacci retracement of March month declines near 0.6230.

AUD/USD daily chart

Trend: Pullback expected