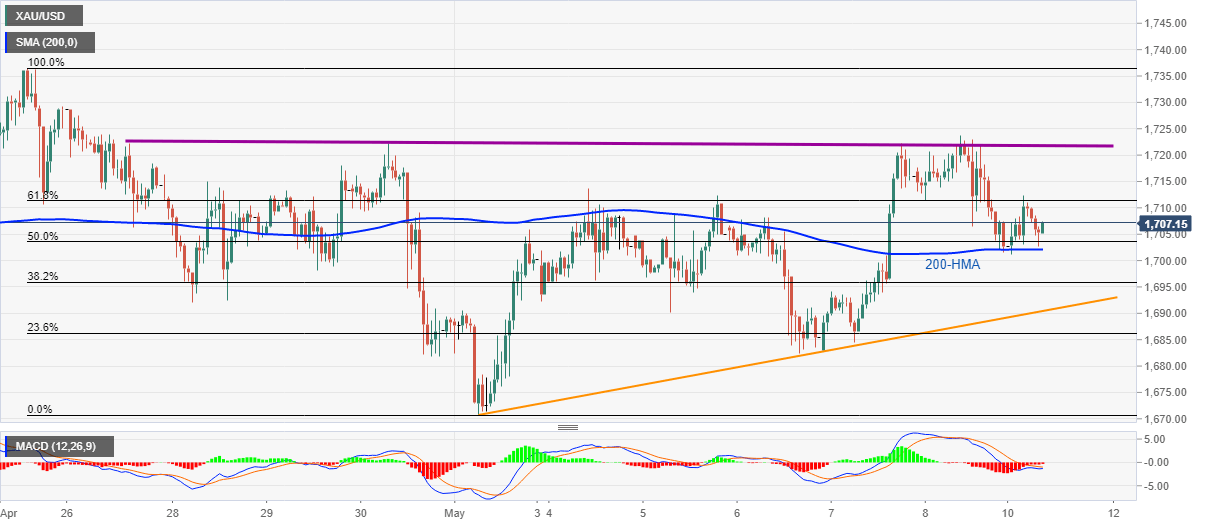

Gold Price Analysis: 200-HMA guards immediate downside above $1,700

- Gold prices remain mildly bid near the above key HMA.

- The monthly support line adds to the supports.

- A two-week-old horizontal resistance cap near-term recoveries.

Gold prices remain mildly positive, up 0.17% on a day, while taking the bids to $1,705.70 amid the early Monday.

Despite failing to cross a fortnight old horizontal support, the yellow metal fails to slip below 200-HMA.

Though, bearish MACD keeps sellers hopeful for a downside to the monthly support line, currently around $1,690, on the break of 200-HMA level of $1,702.

Further, the bullion’s further weakness below $1,690 might avail $1,683/82 as an intermediate halt ahead of targeting to refresh the monthly low near $1,670.

Alternatively, 61.8% Fibonacci retracement of April 24 to May 01 fall, around $1,711/12, seems to limit the pair’s immediate recoveries ahead of fueling them towards the horizontal resistance close to $1,721/22.

If at all the safe-haven manage to cross $1,722, it’s the run-up to the April month top near $1,748 can’t be ruled out.

Gold hourly chart

Trend: Sideways