Fitch Ratings cuts long-term oil price assumptions

In its latest report, the US-based Fitch Ratings reduced its long-term price forecasts for both Brent and West Texas Intermediate (WTI) oil.

Key points

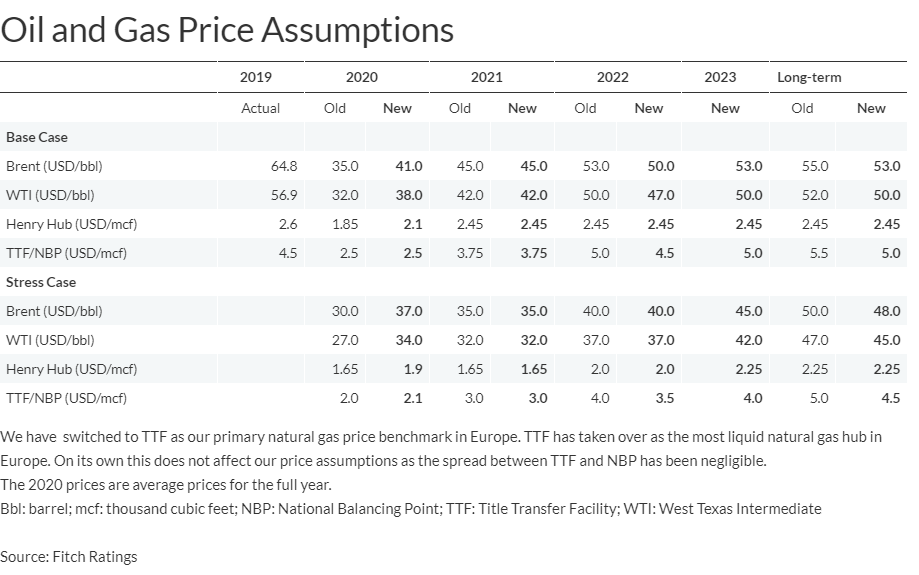

“The cut in the price forecast is to reflect large underutilized production capacities, the extended period of high oil inventory caused by the coronavirus pandemic, falling upstream unit costs and the long-term energy transition.”

“The price reduction comes despite a better-than-expected year-to-date performance due to decisive production cuts by OPEC+, loosened lockdown measures and an economic recovery that has led us to increase our 2020 assumption to USD41/b.”

“We have reduced Brent oil price assumptions to USD50/b in 2022 due to higher inventories, fragile supply-demand dynamics and the decreasing breakeven oil prices across the world. The latter, along with the energy transition, underpin the reduction of our long-term Brent price assumption to USD53/b.”