Back

23 Jun 2021

Gold Futures: Downside seen limited

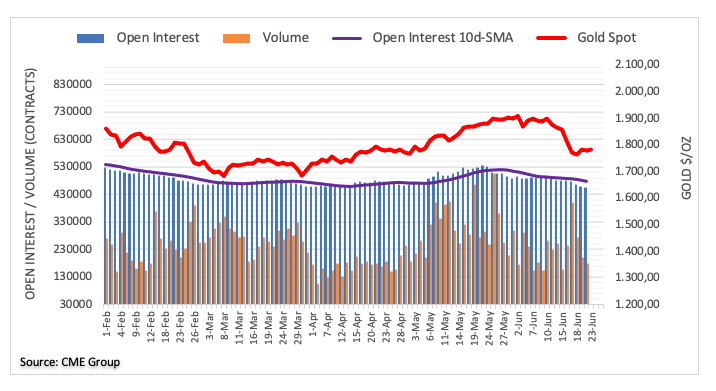

Traders trimmed their open interest positions in gold futures markets for yet another session on Tuesday, this time by around 2.6K contracts. It is worth noting that the downtrend in open interest is in place since June 11. In the same line, volume shrank for the third session in a row, now by around 23.6K contracts.

Gold remains supported around $1,760

Tuesday’s downtick in gold prices was amidst shrinking open interest and volume, leaving the probability of a deeper pullback not favoured in the very near term. That said, the $1,760 mark per ounce troy continues to hold the downside for the time being. Occasional bullish attempts are expected to meet the next hurdle at the $1,800 mark.