Wake Up Wall Street (SPX) (QQQ): Dow, S&P 500 set for records as Nasdaq looks down from lofty perch

Here is what you need to know on Thursday, June 24:

More records beckon for equity markets after the Nasdaq led the way on Wednesday and big tech names continue to flex their muscles. Yesterday saw record highs for FaceBook (FB) and Alphabet (GOGL) while Apple (AAPL) continues its impressive ascent (see more). Tesla (TSLA) staged a powerful break of the $635 level (see more) while meme and crypto stocks were more subdued. Industrial stocks may come back into focus if President Biden's massive infrastructure plan can get closer to the finish line. The bill is moving in the right direction as the President brings negotiators from Democrats and Republicans to the White House later on Thursday.

The dollar has calmed down following a surge last week which stopped a lot of positions out and is at 1.1950 versus the euro. Oil is lower at $72.50, Gold at $1,785 and Bitcoin stable as ever at $33,800! Inflation concerns have been put to one side now after the Fed and the US 10-Year continues to hold under 1.5% while the VIX is lower at 15.

See Forex today

European markets are higher, the FTSE is +0.4%, Dax +0.7% and EuroStoxx +0.8%.

US futures are also higher, Dow +0.5%, Nasdaq +0.6 and S&P +0.5%.

-637601352836025095.png)

Wall street top news

President Biden to meet a group of senators on his infrastructure plan at 1145 AM EST/16GMT.

Bank of England leaves interest rates unchanged, now there's a surprise.

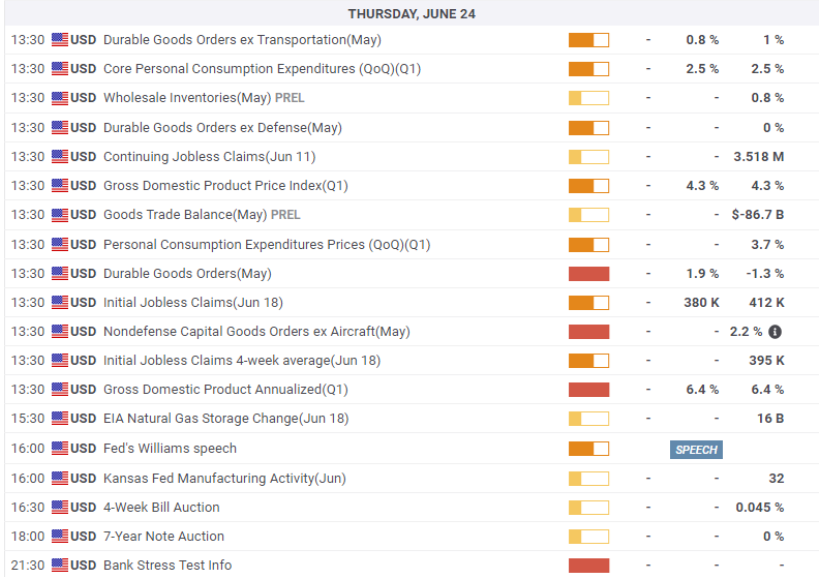

US Jobless claims 411k versus 380k forecast.

US GDP final revision 6.4%.

US Durable Goods 2.3% versus 2.8% forecast.

Deliveroo UK Court of Appeal rules its workers are self-employed.

Eli Lilly (LLY) to file marketing approval for Alzheimer's treatment. Shares up 7% premarket.

Biogen (BIIB) reportedly suffering on Eli (LLY) announcement, shares down 7% premarket.

AMZN Teamsters are due to vote on Thursday for increased efforts to unionize Amazon workers. CNBC.

Prothena (PRTA) announced opt-in by Bristol Myers Squib under neuroscience collaboration. Shares up 14%.

Accenture (ACN) up 4% premarket on positive results and guidance.

Tower Semiconductor (TSEM) agreement with STMicroelectronics on the use of a new site in Italy.

Bed Bath and Beyond (BBBY) upgraded by Bank of America.

First Solar (FSLR) up 5% premarket on talk of US blocking some Chinese solar products.

DHI Group (DHX) boosts share buyback program.

Broadstone Net Lease (BNL) down 5% premarket as announces public stock offering.

Visa (V) buying European banking platform Tink-CNBC.

MGM Resorts upgraded at Deutsche. Up 2% premarket.

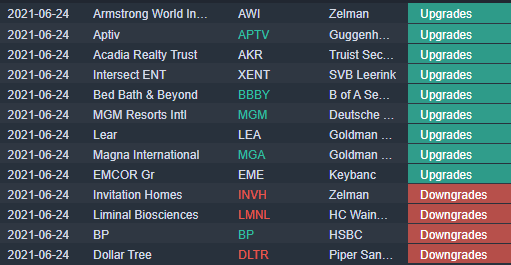

Upgrades, downgrades, premarket movers

Source: Benzinga Pro

Economic releases

Like this article? Help us with some feedback by answering this survey: